Holistic Property Investment Strategy Development and Monitoring Solutions

In the realm of actual estate financial investment, the quest for a comprehensive strategy that includes all aspects of growth and monitoring is a continuous trip. In this discussion, we will discover how a cohesive blend of market evaluation, danger assessment, lasting techniques, ESG concepts, and technological developments can converge to create a durable foundation for efficient real estate financial investment approaches.

Market Analysis for Investment Opportunities

Carrying out a comprehensive market analysis is important for determining lucrative financial investment chances in actual estate. By analyzing market patterns, demand-supply dynamics, economic indicators, and demographic elements, financiers can make educated choices and minimize risks. Market evaluation assists financiers recognize the current state of the real estate market, forecast future patterns, and recognize potential areas for development and profitability.

One essential element of market analysis is determining emerging markets or neighborhoods with high development potential. These areas might display raising home values, climbing demand from renters or buyers, and framework growths that can positively influence building prices - real estate buyback. By concentrating on these growth areas, investors can profit from the admiration of property values and generate eye-catching returns on their financial investments

Moreover, market evaluation allows financiers to examine the competitive landscape and prices methods of various other market players. Understanding the competitors can aid financiers place their financial investments successfully, differentiate their offerings, and optimize their investment returns. On the whole, a comprehensive market analysis develops the foundation for a successful realty investment strategy.

Danger Evaluation and Reduction Approaches

Efficient real estate investment strategies demand a thorough analysis of prospective risks and the execution of durable mitigation measures. Threat evaluation is a vital component of genuine estate financial investment as it allows capitalists to recognize and assess unpredictabilities that can affect their investments.

:max_bytes(150000):strip_icc()/real-estate-what-it-is-and-how-it-works-3305882-1f1ca22206274467862367e2dc59f25b.png)

Lasting Building Monitoring Strategies

Applying lasting residential property monitoring strategies is crucial for enhancing the long-lasting environmental and monetary efficiency of genuine estate investments. By incorporating sustainability methods right into building monitoring approaches, real estate financiers can decrease operational prices, boost asset worth, and draw in ecologically conscious lessees.

In addition, integrating lasting structure materials and methods during construction and renovation tasks can enhance indoor air top quality, decrease waste, and reduced maintenance expenditures gradually (real estate buyback). Sustainable residential or commercial property monitoring likewise includes waste management approaches, such as reusing programs and waste reduction efforts, to minimize environmental influence and promote a much healthier living environment for passengers. Overall, integrating lasting residential or commercial property monitoring techniques not only profits the atmosphere yet also improves the long-lasting profitability and durability of realty investments

Including ESG Concepts in Investments

To enhance the sustainability and honest influence of property investments, integrating Environmental, Social, and Governance (ESG) principles has come to be a pivotal emphasis for diligent financiers. ESG variables play an essential duty fit investment choices, intending to create long-lasting value while considering the broader effect on society and the environment.

Technology Integration for Effective Procedures

Combination of innovative technical remedies is necessary for maximizing functional performance in property financial investments. In today's hectic digital landscape, genuine estate financiers and residential or commercial property managers are increasingly transforming to innovation to enhance procedures, improve renter experiences, and drive success. One key element of innovation integration is using clever structure systems. These systems take advantage of IoT (Internet of Points) technology to automate processes such as home heating, ventilation, air conditioning, illumination, and safety and security, inevitably decreasing energy usage and functional expenses.

In addition, data analytics and AI (Synthetic Intelligence) devices are being used to collect and examine vast amounts of information to make enlightened investment decisions and predict market trends accurately. This data-driven technique allows financiers to determine chances, reduce dangers, and maximize profile performance. Additionally, cloud-based residential property monitoring systems are reinventing exactly how realty possessions are managed, providing central access to crucial information, improving interaction, and promoting collaboration amongst stakeholders.

Final Thought

To conclude, the all natural method to actual estate investment approach development and administration supplies an extensive structure for success. By conducting complete market evaluation, executing danger reduction methods, utilizing sustainable building management techniques, integrating ESG concepts, and incorporating modern technology for reliable procedures, investors can maximize their returns and create long-term value. This method guarantees a all-round and lasting investment strategy that considers all aspects of the realty market.

In this discussion, we will check out Look At This exactly how a cohesive blend of market analysis, threat analysis, sustainable practices, ESG principles, and technical innovations can merge to develop a robust structure for efficient genuine estate investment strategies.

Recognizing the competitors can help investors place their investments efficiently, differentiate their offerings, and maximize their investment returns - real estate buyback. Threat evaluation is a critical element of genuine estate financial investment as it enables capitalists to identify and review unpredictabilities that can influence their investments.Executing lasting home administration strategies is necessary for enhancing the lasting ecological and monetary performance of real estate investments. On the whole, helpful resources integrating lasting building administration methods not only profits the environment yet likewise improves the lasting productivity and strength of actual estate financial investments

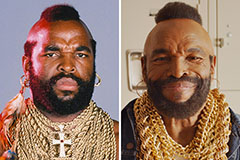

Mr. T Then & Now!

Mr. T Then & Now! Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!